52+ can you deduct mortgage payments on rental property

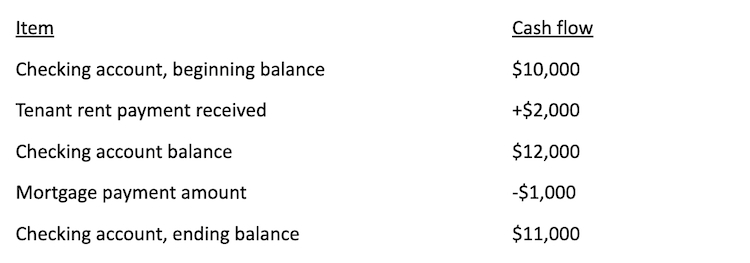

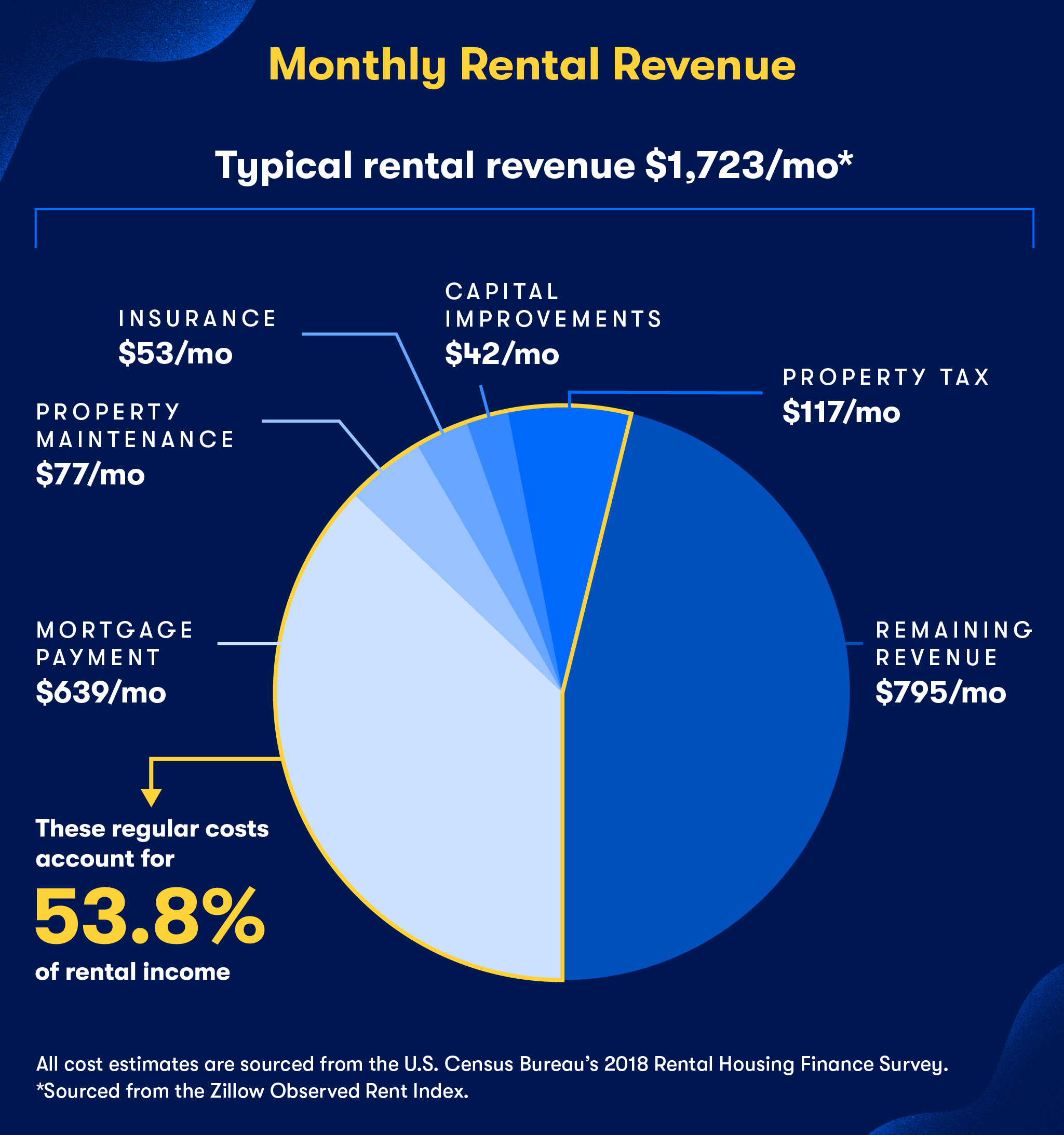

Many other settlement fees and closing costs for. Web If your rental property produces 50000 in rental income for the year you can take a 15000 deduction for the mortgage interest which reduces your taxable rental income.

Can You Deduct The Difference From Rent To Mortgage Payments For A Rental Property

Paying off the mortgage principal isnt a.

. This annual allowance accounts for a propertys wear. The principal that you pay with your mortgage. Web Only the mortgage interest mortgage insurance and property taxes related to the rental property are deductible.

Web Generally deductible closing costs are those for interest certain mortgage points and deductible real estate taxes. You cant write off the red ink on your taxes. Web If your rental income doesnt pay off the mortgage thats bad news for you.

Web Yes if you receive rental income from a property you are entitled to deduct certain expenses including mortgage interest property tax operating expenses. However you can deduct the mortgage interest and real estate taxes that you paid for. Web Taxpayers must recover the cost of rental property through an income tax deduction called depreciation.

Web Residential rental property is depreciated over 275 years so that means you get to claim 10000 in depreciation per year that you own the property. Web Up to 25 cash back Starting in 2018 all businesses with average gross receipts of 25 million or more over the prior three years can deduct interest payments only up to 30 of. Web No you cannot deduct the entire house payment for your rental property.

Web If you itemize your deductions on Schedule A of your 1040 you can deduct the mortgage interest and property taxes youve paid. For tax years before 2018 the.

Rocky Point Times August 2021 By Rocky Point Services Issuu

Can You Deduct Mortgage Interest On A Rental Property

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

Calameo Wallstreetjournal 20160113 The Wall Street Journal

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

Late Rent And Mortgage Payments Rise The New York Times

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

How To Rent Your House And Buy Another Mashvisor

Calameo Ombc Case Water Evidence

Is Your Mortgage Considered An Expense For Rental Property

Can You Write Off The Difference Between The Rent Collected Mortgage Paid

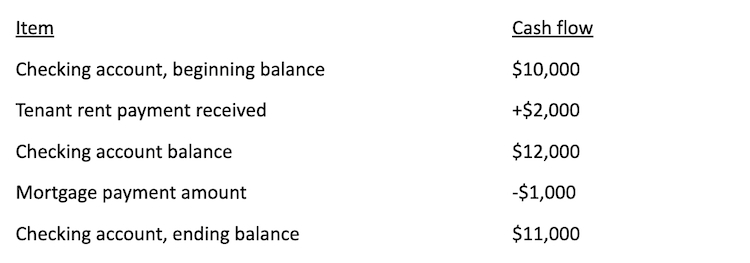

Landlords Brace For Income Shock As Federal Aid For Unemployed Workers Ends Zillow Group

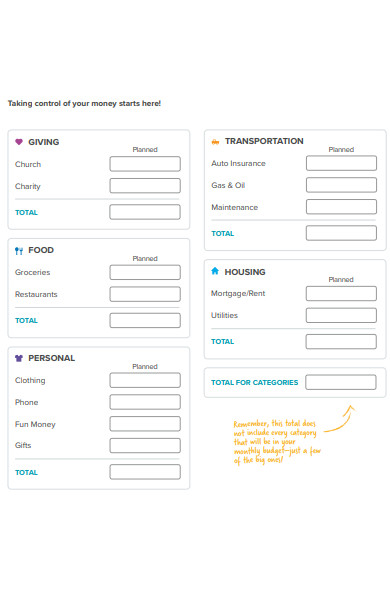

Free 52 Budget Forms In Pdf Ms Word Xls

Rocky Point Times April 2022 By Rocky Point Services Issuu

52 Property In Palakkad Apartments Flats Houses Offices For Sale In Kaipuram Palakkad Justdial Real Estate

How Much Money Will I Make From My Rental Property Rich On Money

Pdf The Gender Employment Gap Costs And Policy Responses